Your construction project needs to be protected against contractor failures! Performance bonds provide essential protection in the construction industry, but many project owners fail to comprehend their operation or significance until after encountering problems.

Construction projects experience multiple risks which can disrupt their completion and cause major budget overruns. Performance bonds provide financial security during project mishaps. This article provides a full overview of performance bonds in construction, explaining their function and demonstrating why they protect your investment.

What You Need to Know:

- What Are Performance Bonds?

- How Performance Bonds Work in Construction

- Key Benefits of Using Performance Bonds

- Who Needs Performance Bonds?

- How to Obtain a Performance Bond

- Performance Bond Costs and Requirements

What Are Performance Bonds?

A performance bond functions as a surety bond that assures the contractor will fulfill the construction project in line with their contractual terms and conditions. The surety company that issued the bond takes responsibility to complete the project or deliver financial compensation when the contractor does not meet their obligations.

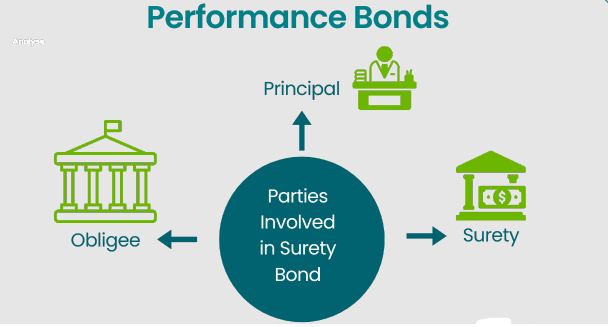

Performance bonds represent a tripartite arrangement involving the contractor who buys the bond as the principal entity along with the project owner who demands the bond and the surety company that underwrites it.

- The principal (contractor) who purchases the bond

- A performance bond is needed by the project owner, who serves as the obligee.

- The insurance company that acts as surety provides support for the bond.

Performance bonds serve as protection against contractor bankruptcy while extending coverage to scenarios where contractors leave projects unfinished or breach quality standards and contractual obligations.

How Performance Bonds Work in Construction

Performance bonds in construction demonstrate simple yet effective operational mechanics. The awarding of a construction contract usually leads to a demand from the project owner for the contractor to obtain a performance bond prior to starting work.

Here’s how the process typically unfolds:

- The contractor applies for a performance bond from a provider for performance bonds like a surety company.

- The surety company will analyse the contractor’s financial health along with their experience and ability to perform.

- The contractor pays a premium which amounts to 1-3% of the contract value to obtain a performance bond.

- After evaluating the contractor’s qualifications, the surety company delivers the bond, which serves as a performance guarantee.

- The performance bond expires after the contractor successfully completes the work.

- The surety intervenes to handle the situation once the contractor fails to perform.

The surety can choose from multiple courses of action when the contractor defaults on their obligations.

- The surety provides financial support to the initial contractor so they can finish the project.

- The surety should bring in another contractor to finish the project.

- The surety compensates the project owner with funds up to the bond amount.

- Work with the contractor to develop a mutually acceptable alternative resolution for the project owner.

Overall default rates decrease when performance bonds are used because unbonded projects tend to default at rates up to ten times higher. The substantial difference reveals the strong impact bonds have on encouraging contractors to meet their responsibilities.

Key Benefits of Using Performance Bonds

Construction projects benefit all participants through the implementation of performance bonds. The advantages offered by performance bonds explain their standardization throughout the construction industry.

For project owners, performance bonds provide:

- Financial protection against contractor default

- Performance bonds allow project owners to ensure that only qualified contractors work on their projects.

- Reduced risks contribute to potential cost savings for projects.

- Smoother project completion even if problems arise

For contractors, performance bonds offer:

- Enhanced credibility with clients

- Competitive advantage in bidding processes

- Better project management discipline

The numbers back up these benefits. The surety bond industry generated $9.3 billion in premium revenue in 2023 which demonstrates stable market demand for these essential risk management instruments. Analysts predict the global surety bond market will expand to $27 billion by 2030 through a Compound Annual Growth Rate of 5.8% starting from 2023.

Who Needs Performance Bonds?

Performance bonds are typically necessary in the following situations:

Government Projects

The Miller Act requires performance bonds for all federal construction projects that reach or exceed $150,000 in value. The majority of state and local governments have enacted their own versions of the Miller Act which impose the same requirements for public works projects.

Commercial and Residential Development

Performance bonds are mandatory for numerous private commercial developments including extensive projects like office buildings and industrial facilities. Municipalities need performance bonds to guarantee proper completion of public improvements such as roads and utilities for large residential developments.

Infrastructure Projects

Complexity and public significance make performance bonds a standard requirement for infrastructure projects such as roads, bridges, and airports.

Investments in public works projects have risen since the Infrastructure Investment and Jobs Act and are anticipated to drive substantial expansion in utilities and public works sectors through infrastructure and renewable energy improvements.

How to Obtain a Performance Bond

To obtain a performance bond, contractors must prepare thoroughly and know the criteria that sureties use to evaluate them. Here’s a step-by-step guide:

- Select an established surety company or construction bond-specialised bond broker for your surety bond needs.

- Assemble your financial documentation by collecting financial statements along with tax returns, bank references and proof of your company’s performance history.

- Fill out the application form provided by the surety and submit the necessary supporting documentation.

- The underwriting process involves the surety’s evaluation of your financial strength along with your experience in similar projects, existing workload, credit history, and management team capabilities.

- After bond approval, you will receive the bond, which must be presented to the project owner.

Contractors who demonstrate strong financial standing and a good reputation experience a simple and direct process. New contractors benefit from partnering with bond providers who specialise in construction risks because these providers bring essential understanding to the process.

Performance Bond Costs and Requirements

The cost of performance bonds typically falls between 1% and 3% of the total contract value. The bond premium for a $1 million contract will likely fall between $10,000 and $30,000.

Key factors affecting bond costs include:

- Bond providers offer improved rates to contractors who demonstrate robust financial strength through strong balance sheets and positive net worth.

- When contractors demonstrate a history of completing similar projects successfully it results in reduced insurance premiums.

- The size and complexity of contracts result in higher bond rates because they involve greater risks for larger projects.

- Extended project timelines result in increased bond premiums.

The standard requirement for performance bonds is to provide 100% coverage of the contract value, which protects project owners from potential financial losses. Bonds stay active through to the completion of the project and the owner’s final acceptance.

Bond premiums represent a single initial payment rather than recurring yearly expenses, as seen with insurance. Contractors who need bonds frequently will find better terms by building a strong relationship with their surety provider.

The Bottom Line on Performance Bonds

In construction projects, performance bonds establish both protection for project owners and accountability mechanisms for contractors.

The data clearly shows that bonded projects face lower risks of complete failure and any arising issues result in substantially diminished financial consequences. The performance bonds continue to act as a fundamental component of construction risk management evidenced by the surety bond industry’s $9.3 billion in premium writings during 2023.

Project owners who want protection and contractors who aim to strengthen their market position both need to understand performance bonds to succeed in modern construction environments. To make performance bonds work for your construction needs you should partner with knowledgeable bond providers while keeping your finances strong and planning your projects cautiously.