The management of public projects includes making good decisions, and these decisions usually involve choosing between alternatives. Therefore, every decision-maker needs to answer questions like what public projects to implement, how to begin, how many project units are required, and where and when to execute these projects. Economic analysis helps the decision-maker to determine answers to these questions.

For every public project conceived, there must be very clear goals, benefits, and expectations from the project during and when it is completed. Complying with these objectives with minimum cost and maximum benefits is crucial because public projects are usually executed using public funds and tax revenues. Therefore, executing public projects involves many choices among physically feasible alternatives. Some examples of public projects are roads, bridges, hospitals, dams, leisure centres, etc

Furthermore, each choice among alternatives should be made on an economic basis. In addition, each alternative should be expressed in terms of money units before making the final choice. Money units can only measure the cost and benefits of different project alternatives.

Public vs Private Projects

The economic analysis of public projects uses a different approach for evaluation compared to private projects. The focus is usually on benefits instead of profits, as in the case of private projects. In addition, the scope is the society; that is, it covers the interest of the owner and the society. Therefore, benefits becomes the performance criterion instead of profitability.

Economic Analysis of Public Projects

The best project is the one which gives the highest benefit-cost (B/C) ratios as it would give the maximum return on investment (ROI). On the contrary, public projects are usually executed to achieve maximum benefits and not maximum B/C ratios. However, projects should be economically viable and give some minimum return rate (RoR).

It has been observed in most public projects that benefit increase with the size of the project. However, project cost also increases with the increase in project size. Furthermore, a stage is reached beyond which an increase in project size may not yield minimum attractive returns. Therefore, the size of the project is fixed at this stage.

Key Test

It has always been easy to determine costs but determining full benefits remains challenging. Therefore, before economic analysis can proceed, efforts must be made to list possible benefits and estimated values. A decision-maker should accept projects as viable (economically acceptable) if benefits outweigh costs. In addition, the projects should be implemented, subject to the availability of funds.

Benefit-Cost Ratio

The benefit-cost ratio (B/C) compares the present value of all benefits to the present value of all costs. The ratio is merely used to see if a unit of costs (say, #1) will return at least the same unit (#1) in benefits. B/C ratios do not themselves provide enough information to make an economic choice. Therefore, additional calculations are necessary to use B/C ratios as a sound basis for project formulation.

Conditions for Viability

- Accept projects as viable (economically acceptable) if benefits outweighs cost, that is, B/C > 1.0

- Reject project if B/C < 1.0

Steps in Checking the Viability of Projects

- Carryout incremental analysis on the projects, that is, arrange projects in increasing order of costs.

- Put the projects in a portfolio from best to worst, noting cumulative cost values.

- Stop when funding limit is reached.

- Fund only the acceptable projects within limits.

- If there is any extra fund, invest in some other venture or keep money in bank.

Worked Example

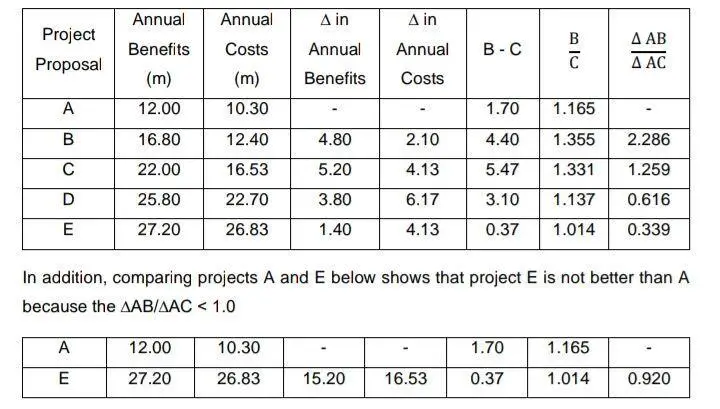

The information about 5 proposed public projects are given below.

| Project Proposal | Annual Benefits (millions) | Annual Cost (Million) |

| A | 12.00 | 10.30 |

| B | 16.80 | 12.40 |

| C | 22.00 | 16.53 |

| D | 25.80 | 22.70 |

| E | 27.20 | 26.83 |

a) Determine the projects that are viable.

b) Determine the best project.

c) If there is a budget of 40 million, determine the projects to adopt for execution.

Solution

a) All the projects are viable because their B/C > 1.0

b) The best project is B because it has the highest ∆AB/∆AC value of 2.286

c) With a budget of 40 million, projects A, B and C with overall cost of 39.23 million should be adopted for execution

Conclusion

The main purpose of economic analysis is to help select projects that contribute to the welfare of the people. Therefore, economic analysis is most useful when used early in the project cycle to catch bad projects and bad project components. However, if used at the end of the project cycle, economic analysis can only help decide whether or not to proceed with a project.

One of the most important steps in project evaluation is the consideration of alternatives throughout the project cycle, from identification through appraisal. Many important choices are made early when alternatives are rejected or retained for a more detailed study. Comparing mutually exclusive options is one of the principal reasons for applying economic analysis from the early stages of the project cycle.

Finally, an economical design is that project which gives the greatest excess benefits over cost. Moreover, a project should be evaluated in terms of RoR. The RoR (net gain or loss over a specified period) on investment may be estimated by calculating the cost and benefits of the project. Projects may also be ranked in the merit of RoR. Thus, the decision to go ahead can be made based on the minimum RoR and B/C ratio.

Reference

[1] Belli, P., Anderson, J., Barnum, H., Dixon, J. and Tan, J-P (1997), Handbook of Economic Analysis of Investment Operations, Operations Policy Department: Learning and Leadership Center. https://www.unisdr.org